When it comes to finding a place to store your savings, you have a surprising amount of options. You can put it in your mattress, apply it to your local bank or credit union, or if you’re tech savvy, you can open an online savings account. Many people are deeply attracted to these exits for savings accounts because they offer such income and returns. I will give you instant information about your account. Many of the major banks turned heads after Direct ING Direct found success in offering savings accounts and soon followed suit. Today we will review HSBC’s first world savings account, the HSBC Direct Online Savings Account.

A lot with online savings accounts, you’re dealing with banks that haven’t been around long, and you don’t have a track record of success. HSBC is certainly an exception to this trend. It has been open since 1850 and has over 400 branches in New York. It is headquartered in Wilmington, Delaware and has nearly 43,000 employees. It’s no wonder why their slogan is “The World’s Biggest Bank”. We all know that bigger does not necessarily mean better. HSBC has been around for a while, but their online savings is a great place to put your money. ? Let’s find out.

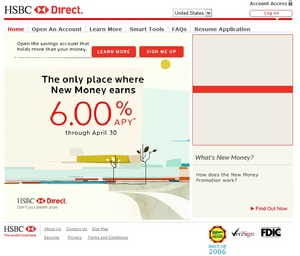

Perhaps the most prominent reason people consider the HSBC Direct is its very high interest rate. HSBC Direct is also offering a promotional rate of 6.00% APY on any new funds until April 30th. Their savings rate for everyone else is 5.05%, which is very competitive in the internet savings world. Major banks offer rates around 5.30% APY, however, they are usually new banks that have not yet established a great reputation. In addition, the account has no monthly fees and no minimum balance, which is par for the course in the world of online savings. Another great benefit of choosing HSBC’s direct online savings account is that you can deposit or withdraw money at any HSBC withdrawal. If you live in the northeast, this will be a great benefit to you. All funds deposited in HSBC accounts are FDIC insured up to $100,000.

HSBC has several security features to keep your money safe from any hacker or person who wants to access your account. All data transferred between your computer and HSBC Direct are encrypted with 128-Bit SSL encryption. In addition, HSBC does an excellent job with its servers by managing intrusion detection tools and a series of firewalls to keep your account information safe.

The signup process is pretty typical of online savings accounts. You apply online, give them your personal information, and then they’ll ask you about your reputation to make sure you’re who you say you are. You don’t have any messages for anything. They will send two deposits into the checking account trial to fund the account from your savings. You go to a separate page and type in these numbers to identify your account.

After reviewing your trial deposits, you should wait to play. HSBC Send a screw mail to you two letters from New York. They will send you a customer and password in two different letters to allow you to login. This can take about two weeks if you live in the west! Once you have that information, you can open and external transfer to move money between HSBC Direct. therefore and because of the check. You will receive the HsBC machine card in a few days. It takes a bit of a delay for this reason, but it’s not a deal breaker.

Super HSBC direct team provides more than adequate customer. They offer a toll-free support number that is available 24/7. Other bloggers shared that they had overall positive experiences when working with customer-service teams. This is definitely not the case with all online savings accounts.

At the end of the day the HSBC Direct online savings account is a decent place to put your savings. Their prices have remained competitive, customer-skills”>service dealers, and you can use your HSBC debit card .to deposit and withdraw money.