How to File for Unemployment or Weekly Certification in TN for Temporary Layoff and Seasonal Workers

I have worked and lived in Sevierville, TN for 12 years. Pigeon Forge dinner shows and Gatlinburg wineries and shops is a source of employment for residents as far as Knoxville, TN. Both areas are subject to the fluctuation of seasonal visitors. My wife and I have applied for temporary unemployment over the years. This article is to help relieve the frustration associated with the dysfunctions of this service. Listed are weekly certification questions and how to answer them including were to apply and how.

Note: Unemployment checks even without delays may take up to a month to receive, so prepare finances early.

Where and How to File for Unemployment in TN

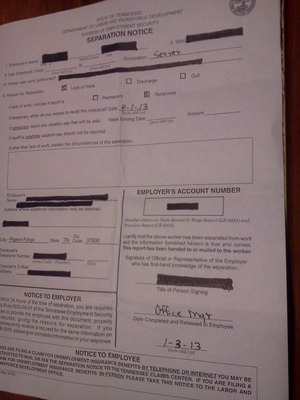

Employers give a “Separation Notice”. A separation notice includes the employers account #, name and address, signature of the Employer knowledgeable of your separation and release date. Seasonal workers reason for separation is “Lack of work” and layoff is “Temporary” followed by an expected call back date.

I typically file online at the TN Dept. of Labor and Workforce Development but you can visit a local career center found on the TN Dept of Labor and Workforce main page. Unfortunately, these locations don’t offer much help for claim disputes or errors.

When filing for unemployment make sure to not open a previous year’s unemployment claim as benefits will end and reopening a past due claim has to be done at a main office or by phone. Between January and March this is time consuming and difficult.

The main reason for delays (Unemployment offices will confess to it) is misleading questions that occasionally change. Weekly certifications are done on Sunday and Monday depending on the last digit of your SSN# with makeup claims Tuesday- Friday 7am to 6:30pm. My wife works and certifies on Sunday which closes at 5pm, so usually has to do a makeup certification on Tuesday for Sunday the PREVIOUS week. Here are the questions asked and how they need to be answered.

Did you do any work for an employer including temporary, part-time or full-time?

Answer: Temporary workers who generally work one day answer YES.

Are you still working?

Answer: The trick question. “Lack of Work” employees will answer YES. Almost everyone answers “no” including me.

What is your hourly rate of pay?

Answer: Most employees enter an hourly rate. Servers or gratuity jobs have to take the following questions answer “# of hours worked” x pay rate, plus tips claimed, divided by hours worked.

Example: Most servers pay rate ($2.13hr x 8hr day = $17.04) + tips claimed, example $50($50+$17.04=$67.04) Divided by hours worked ($67.04 8hrs worked=$8.38 hourly pay) your answer would be $8.38 hourly rate.

What is the total number of hours you worked during this week?

Answer: Previous example 8, but from clock in to clock out. For servers it’s best to keep your clock out slip for later reference. We buy 2yr planners and figure our hourly rate to write in on the appropriate date to save time on weekly certification.

If you are on a permanent layoff or do not expect to return to work to the same employer within 21 days, you should not report holiday or vacation pay. Did you receive any holiday or vacation pay during this week?

Answer: If yes, only claim if temporarily laid off.

Did you refuse any offers of work for this week? Answer: Yes or No

Did you enter a college or university this week? Answer: Yes or No

Did you begin receiving or have a change to any type of pension other than social security? Answer: Yes or No

Did you receive any payment for temporary disability under worker’s compensation during the week listed above? Answer: Yes or No

Were you able, available and seeking work at a minimum of 20 hours a week during the week listed above?

Answer: Yes. Trick question for seasonal workers. Technically you are supposed to seek work though temporarily unemployed, but probably are not going to find a job for two months that doesn’t need you on weekends.

Bottom of Page: For additional assistance regarding benefit information: If you filed your initial claim through the Internet or by telephone, contact us at 615-253-0800 (from within the Nashville area) or toll-free at 877-813-0950 (from outside the Nashville area) Otherwise, contact the Employment Security office where you filed your claim. See what else you can do online at TN.gov – The official Web site for the State of Tennessee

Receiving Unemployment Checks and Earning Limits

One nice option the Tennessee Dept of Labor offers is once a claim is filed, you can check payment benefits and status on the TN Unemployment website and send payments by direct deposit to bank accounts saving TN money and you gas.

After applying for unemployment, you first receive a “Wage Transcription and Initial Monetary Determination” letter approving or denying unemployment benefits within a few weeks. If you don’t, then you need to start calling. This letter will list the amount of benefits you will receive weekly and for how long. Below your name and address is the amount you can claim without reducing benefits. When applying, I suggest withholding taxes from unemployment benefits, so that you owe less when filing the previous year’s taxes also in January.

I hope this guide will make receiving benefits less of a hassle for all the seasonal workers trying to receive benefits faster.

Please visit my DIY website @ DIYforanyone.com for more home improvement and money saving tips.