Money is security for a lot of people. If they can have enough in the bank, they feel safe. You need access to enough cash to cover at least the small financial emergencies that arise. Building a financial safety net will assure that you are able to weather most financial storms that pass through your life.

A financial safety net does not just mean a pile of money.

While money is nice, few people have enough cash to qualify as a true safety net. This is especially true of those in the first half of their working lives. Younger people tend to rely on their parents as a financial safety net. Credit cards, home equity, friends, personal finances, insurance and additional income sources can all play a part in your financial safety net.

Good credit can underwrite your safety net.

Although you do not want to rely on credit exclusively as quick source of emergency money, having good credit can go a long way toward getting you past a financial hurdle. There are times when you do not have financial disaster. You just need some fast cash to make up a shortfall. As long as this is not your only available source of money help, you should include some credit availability in your building your financial safety net until you have enough cash that credit is not necessary.

Maintain relationships with those who can help you in an emergency.

Friends, family, and business associates may all have good reasons to help you through a tough financial time. A few hundred dollars here and there can add up to a decent sum when you have to have it. Family is an especially good resource because they usually want you to succeed. Gifts and loans from these sources can be invaluable when you are seeking immediate assistance.

Structure your own finances with long and short term safety in mind.

Even your own money needs to be put in accounts that can be used when needed. Smaller sums tend to be needed quickly. Large amounts tend to have longer time lines attached to them. This means that you need a few thousand near your hand. The larger share of your personal money can be invested in ways that can require a few days or weeks to access it.

Develop sources of fall back income.

Any source of income that provides you as much as $50 per month may be considered part of your safety net. This money can make the difference between being short a few dollars and having a little extra in the bank. Any income that can get you closer to the amount of money that you need is added security.

Use insurance as a last line of defense.

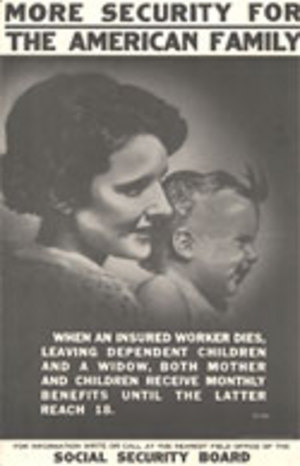

Insurance takes some of the risk out of y.our life. Disability insurance means that you have income if you get injured or sick. Health insurance removes some of the risk of falling into medical bankruptcy. Having your home, car, and other possessions insured protects you against losses, damage, and other hazards that may come along to eat away your finances. Life insurance takes care of your family’s finances if you die.